UK Infrastructure Trends: Critical Shifts Reshaping Britain’s Future in 2025

The UK’s infrastructure landscape stands at a pivotal moment in 2025, shaped by a new Labour government’s ambitious policies and the urgent need to meet net zero carbon targets. Major shifts in energy systems, transport networks, and digital infrastructure are creating both unprecedented opportunities and significant challenges for the nation’s development. The government’s acceleration of key programmes, including the National Energy System Operator and National Wealth Fund, signals a fundamental transformation in how Britain approaches infrastructure investment.

This transformation extends far beyond traditional building projects. Digital innovation is revolutionising how infrastructure operates, with estimates suggesting that digitalisation across UK infrastructure could contribute £413 billion to economic growth by 2030. Meanwhile, the push towards renewable energy generation and storage systems is reshaping the entire energy sector.

Transport networks face equally dramatic changes as the country works towards its 2050 vision for sustainable mobility. From electric vehicle charging infrastructure to smart transport systems, the sector must balance immediate needs with long-term environmental goals whilst addressing persistent skills shortages and funding challenges.

UK Infrastructure at a Turning Point

The UK government’s new 10-year infrastructure strategy represents a major shift in planning and investment, whilst the newly established NISTA takes responsibility for delivering transformational infrastructure projects.

It’s fair to say the UK infrastructure market is entering another pivotal period. The backdrop is complex—energy reforms, new investment commitments, digital transformation, and transport developments—but the direction of travel remains clear: long-term growth, and with it, strong demand for project controls and commercial management expertise.

Overview of Current Strategy and Policy

The UK has launched its first comprehensive 10-year infrastructure strategy that combines economic, housing, and social infrastructure planning. This marks a significant change from previous approaches.

The strategy covers transport, energy, water, digital networks, and flood defences alongside housing and social infrastructure like hospitals and schools. For the first time, these areas are planned together rather than separately.

The government aims to use infrastructure investment as the main driver for economic growth. The strategy also focuses on regional rebalancing to reduce inequality between different parts of the country.

Net zero transition forms a central part of the new approach. The strategy aligns infrastructure development with climate targets and carbon reduction goals.

Digital transformation plays a key role in the strategy. Government analysis suggests digitalisation across UK infrastructure could add £413 billion to the economy by 2030.

Role of the National Infrastructure and Service Transformation Authority (NISTA)

NISTA has been established to oversee and deliver major infrastructure projects across the UK. The authority replaces previous arrangements and takes a more coordinated approach to project delivery.

The organisation focuses on improving project planning and execution. This addresses longstanding issues with delays and cost overruns that have affected major UK infrastructure projects.

NISTA’s responsibilities include:

- Coordinating delivery across different infrastructure sectors

- Ensuring projects align with government strategy

- Improving project management standards

- Supporting regional development goals

The authority works to reduce complexity in infrastructure delivery. It aims to streamline processes that previously involved multiple government departments and agencies.

NISTA also supports the government’s commitment to nuclear energy development and carbon capture initiatives.

Spending Review and Investment Priorities

The recent spending review has allocated significant funding for infrastructure development. The government has committed substantial resources to energy, transport, and digital infrastructure.

Key investment priorities include:

- Nuclear energy programmes with dedicated funding streams

- Carbon capture and storage initiatives

- Digital infrastructure expansion

- Transport network improvements

The spending review confirms infrastructure investment as a government priority. Funding levels reflect the scale of transformation needed to meet net zero targets.

Investment focuses on projects that deliver both economic growth and environmental benefits. The government balances immediate infrastructure needs with long-term strategic goals.

Regional development receives particular attention in spending allocations. The review supports infrastructure projects that help reduce economic disparities between different areas of the UK.

Energy Infrastructure Evolution

The UK’s energy infrastructure is undergoing massive changes driven by net-zero commitments and technological advances. Key developments include aggressive decarbonisation targets, renewable energy expansion, nuclear power modernisation, and carbon capture initiatives.

Decarbonisation and Electrification Goals

The UK government has set ambitious targets to reach net-zero carbon emissions by 2050. This requires a complete transformation of how the country generates and uses energy.

Electrification plays a central role in these plans. The National Grid must handle increased electricity demand from electric vehicles, heat pumps, and industrial processes.

The National Wealth Fund, together with private partners, has committed £500m to battery storage developer Eelpower, with the goal of building 1GW of capacity by 2030. This is not just an energy story—it’s a project pipeline story. Storage projects will require integration with grid infrastructure, long-term asset planning, and detailed risk management, all areas where specialist talent is essential

Key electrification targets include:

- All new car sales to be electric by 2030

- Heat pump installations in millions of homes

- Industrial processes switching from gas to electricity

The National Energy System Operator will coordinate this transition. This new body replaces parts of the existing grid management system.

Energy storage becomes critical as electricity demand grows. Battery systems and other storage technologies must balance supply and demand across the network.

Expansion of Renewable Energy

Renewable energy capacity continues growing rapidly across the UK. Wind power leads this expansion, both onshore and offshore.

Offshore wind farms generate the most new renewable capacity. The government plans to reach 50GW of offshore wind by 2030.

Solar power installations are increasing on homes and commercial buildings. Large-scale solar farms also contribute to the renewable mix.

Current renewable energy breakdown:

- Wind: 60% of renewable generation

- Solar: 20% of renewable generation

- Hydroelectric: 15% of renewable generation

- Biomass: 5% of renewable generation

Grid infrastructure needs major upgrades to handle renewable energy. New transmission lines connect wind farms to population centres.

Smart grid technology helps manage variable renewable output. This includes automated systems that balance supply and demand in real-time.

Nuclear Power and Small Modular Reactors (SMRs)

Nuclear energy remains part of the UK’s long-term energy strategy. Existing nuclear plants provide steady baseload power alongside renewables.

The government supports new nuclear projects to replace ageing reactors. Hinkley Point C represents the largest current nuclear investment.

Small Modular Reactors offer a new approach to nuclear power. SMRs cost less to build than traditional nuclear plants.

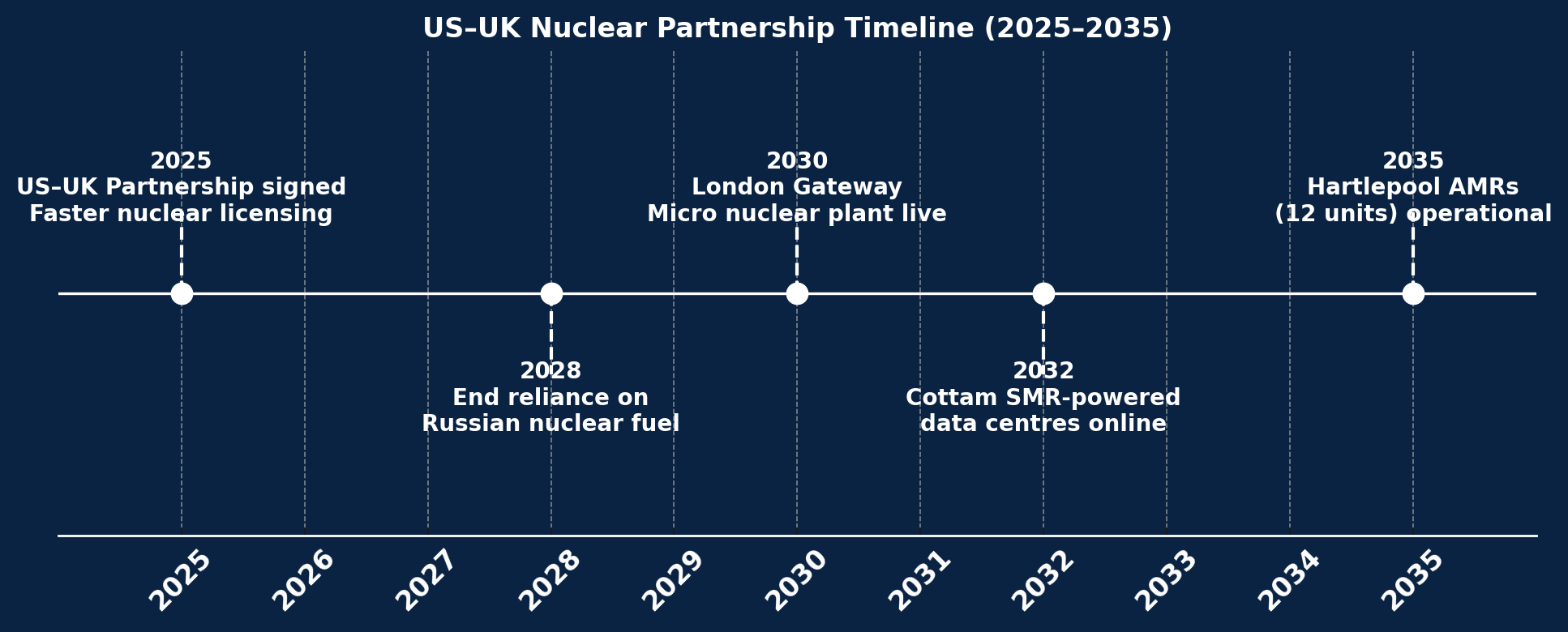

In 2025, the United States and United Kingdom signed the Atlantic Partnership for Advanced Nuclear Energy, a landmark deal to speed up clean power innovation.

The agreement halves licensing times, boosts energy security by ending reliance on Russian nuclear fuel by 2028, and supports next-gen technologies like SMRs and AMRs.

Major projects are already in motion: 12 AMRs in Hartlepool (powering 1.5m homes, creating 2,500 jobs), SMR-powered data centres at Cottam, and a micro nuclear plant at London Gateway port.

SMR advantages include:

- Faster construction times

- Lower upfront costs

- Enhanced safety systems

- Flexibility in placement

Several SMR designs are under development in the UK. The government has allocated funding for SMR research and testing.

Nuclear power provides reliable electricity when wind and solar output drops. This makes it valuable for grid stability.

Carbon Capture and Storage Initiatives

Carbon capture and storage technology removes CO2 from industrial processes and power generation. The UK is developing several major CCS projects.

Industrial clusters in areas like Teesside and Merseyside will use shared CCS infrastructure. This reduces costs for individual companies.

CCS process steps:

- Capture CO2 from industrial emissions

- Transport via pipelines

- Store permanently underground

The government provides funding support for early CCS projects. This helps prove the technology works at commercial scale.

CCS enables some industries to reduce emissions without completely changing their processes. Steel and cement production particularly benefit from this approach.

Offshore storage sites use depleted oil and gas fields in the North Sea. These locations can safely store millions of tonnes of CO2.

Technological Transformation Across Infrastructure Sectors

UK infrastructure sectors are experiencing rapid digital transformation as traditional systems integrate smart technologies and data-driven solutions. This shift demands new cybersecurity measures, expanded data processing capabilities, and significant workforce development to manage increasingly connected networks.

Digital Integration and Smart Infrastructure

Digital technologies are revolutionising UK infrastructure across energy, transport, and utilities sectors. Traditional systems are being replaced with intelligent networks that provide real-time monitoring and automated responses.

The energy sector leads this transformation. Smart grids allow utilities to balance supply and demand automatically. These systems can detect outages instantly and reroute power to minimise disruptions.

Transport infrastructure benefits from connected systems too. Traffic management systems use sensors to optimise signal timing. Rail networks employ predictive maintenance to prevent delays.

Water and waste management sectors use digital sensors to monitor quality and flow rates. These systems alert operators to problems before they become serious issues.

However, connected infrastructure creates new risks. System failures now have wider impacts because networks depend on each other. A problem in one area can quickly spread to other sectors.

Cybersecurity for Critical Systems

Connected infrastructure faces growing cybersecurity threats. Critical systems that once operated in isolation now connect to the internet and other networks.

Energy networks represent prime targets for cyber attacks. The National Energy System Operator must protect grid control systems from hackers who could cause widespread blackouts.

Transport systems also face risks. Railway signalling and air traffic control systems need robust protection. A successful attack could endanger public safety.

Water treatment facilities use digital controls that hackers could target. Attacks on these systems could disrupt supplies or contaminate drinking water.

The government requires infrastructure operators to meet strict cybersecurity standards. Companies must report incidents and follow security protocols.

Investment in cybersecurity continues to grow. Infrastructure firms spend millions on protective systems and security staff training.

The Role of Data Centres and AI

Data centres, already a hot topic, are now looking at on-site gas generation to guarantee supply—up to 2.5GW of additional capacity is being explored across southern England. While this raises questions about sustainability, it also creates demand for planning, cost control, and commercial frameworks to manage rapid, large-scale delivery. The reality is that technology growth isn’t slowing down, and infrastructure must find ways to keep pace.

Data centres form the backbone of digital infrastructure transformation. These facilities process vast amounts of information from connected systems across all sectors.

AI systems analyse infrastructure data to predict failures and optimise performance. Machine learning algorithms can spot patterns that human operators might miss.

The demand for data processing power creates challenges. New data centres need enormous amounts of electricity. Grid connection delays often stretch beyond a decade for large facilities.

Energy costs also affect data centre expansion. High electricity prices make some projects uneconomical. This limits the UK’s ability to support growing digital infrastructure needs.

Edge computing brings processing closer to infrastructure systems. This reduces delays and improves response times for critical applications.

Impacts on Workforce and Skills

Digital transformation creates new skill requirements across infrastructure sectors. Workers need training in digital systems, data analysis, and cybersecurity.

Traditional roles are changing rapidly. Engineers now work with software as much as hardware. Operators must understand complex digital interfaces and automated systems.

Skills shortages affect many infrastructure sectors. Companies struggle to find workers with both technical knowledge and digital expertise.

Training programmes help existing workers adapt to new technologies. Universities also develop courses focused on digital infrastructure management.

The sector faces competition from tech companies for skilled workers. Higher salaries in technology firms make recruitment challenging for infrastructure operators.

Apprenticeship schemes combine traditional infrastructure knowledge with digital skills. These programmes help build the workforce needed for transformed infrastructure systems.

Transport Infrastructure Modernisation

The UK’s transport networks are undergoing significant transformation through strategic investments in electrification, rail upgrades, and integrated mobility systems. Government initiatives focus on decarbonisation whilst improving connectivity across regions through modernised infrastructure.

Major Public Transport Investments and Regional Priorities

The UK government has committed substantial funding to transform public transport networks across England, Scotland, Wales, and Northern Ireland. Major investments target bus rapid transit systems, light rail expansion, and improved connectivity between urban centres and rural communities.

Regional priorities include the Northern Powerhouse Rail project connecting Manchester, Leeds, and Sheffield. Scotland receives funding for Glasgow’s subway modernisation and Edinburgh’s tram network expansion.

Key Investment Areas:

- Bus fleet replacement programmes

- Metro system upgrades in major cities

- Cross-regional rail connections

- Rural transport accessibility improvements

Wales benefits from enhanced rail links between Cardiff, Swansea, and North Wales. Northern Ireland’s infrastructure investment focuses on Belfast’s transport hub development and improved connections to the Republic of Ireland.

The zero-emission bus initiative represents a significant shift towards cleaner public transport. Local authorities receive grants to replace diesel buses with electric and hydrogen alternatives.

A new agreement with Germany has reopened the door for direct London–Berlin rail services, with Eurostar, Trenitalia, and Gemini all vying for market share. This renewed competition across the Channel reflects a wider push for sustainable passenger travel and positions rail as a critical part of the UK’s long-term infrastructure strategy.

For our field, international projects like these bring complexity in planning, delivery, and commercial arrangements—challenges that translate directly into opportunity for experienced professionals. High-speed ICE trains link Munich & Berlin. Several types operate this route including ICE1, ICE3, ICE4 & ICE-T.

Rail Electrification and Upgrades

Rail electrification forms a cornerstone of the UK’s decarbonisation strategy. The national grid supports expanded electrification programmes across major rail corridors, reducing dependence on diesel trains.

Network Rail prioritises the Great Western Main Line electrification completion and Midland Main Line upgrades. These projects improve journey times whilst reducing carbon emissions by up to 40%.

Electrification Projects:

- Trans-Pennine Route upgrades

- East Coast Main Line enhancements

- West Coast connectivity improvements

- Branch line electrification programmes

High-speed rail development through HS2 creates new electrified infrastructure connecting London to Birmingham, Manchester, and Leeds. This generates capacity for additional services on existing lines.

Digital signalling systems accompany electrification projects. These technologies increase train frequency and improve safety across the network.

Infrastructure investment includes new substations and power supply systems. The national grid requires significant upgrades to support increased electrical demand from rail operations.

Electrification of Road Networks

Road network electrification centres on electric vehicle charging infrastructure deployment across motorways, A-roads, and urban areas. The government targets comprehensive coverage by 2030.

Charging Infrastructure Development:

- Rapid charging hubs at service stations

- Destination charging at retail locations

- Residential charging point installations

- Workplace charging facilities

Smart charging systems integrate with the national grid to manage electricity demand. These technologies prevent network overload during peak charging periods.

Heavy goods vehicle electrification requires specialised infrastructure. Trials of overhead electric lines on motorway sections support long-distance freight transport decarbonisation.

Local authorities install lamp post charging points in residential areas. This addresses charging access for households without private parking.

The electricity grid receives substantial upgrades to support increased EV adoption. New substations and enhanced transmission capacity ensure reliable power supply for transport electrification.

Integrated Mobility and Connectivity

Integrated transport systems combine multiple modes through digital platforms and physical infrastructure connections. Smart ticketing enables seamless journeys across buses, trains, and light rail networks.

Mobility-as-a-Service platforms integrate public transport with bike-share schemes, e-scooters, and ride-sharing services. These systems reduce private car dependency in urban areas.

Integration Features:

- Multi-modal transport hubs

- Real-time journey planning apps

- Contactless payment systems

- Shared mobility infrastructure

Transport hubs incorporate electric vehicle charging, cycle parking, and public transport connections. These facilities support sustainable travel choices.

Data connectivity through 5G networks enables real-time traffic management and passenger information systems. Smart traffic lights optimise vehicle flow and reduce congestion.

Infrastructure sectors collaborate to deliver integrated solutions. Energy, digital, and transport networks align to support connected mobility services across the UK.

Future Challenges and Opportunities for UK Infrastructure

The UK’s infrastructure sector faces significant hurdles around workforce development and environmental targets, whilst new partnership models and policy frameworks create paths for sustainable growth. Critical skills shortages threaten project delivery timelines, yet emerging public-private collaborations offer innovative funding solutions.

Addressing Skills Gaps and Workforce Resilience

The UK infrastructure sector confronts a severe skills shortage that threatens major project delivery. Current estimates suggest a shortfall of over 200,000 skilled workers across construction, engineering, and digital infrastructure roles by 2030.

Training programmes struggle to keep pace with technological advances. Traditional apprenticeships fail to address emerging needs in renewable energy systems and smart infrastructure management.

Key skill gaps include:

- Digital infrastructure specialists

- Renewable energy technicians

- Project management professionals

- Data centre operations staff

Regional disparities compound these challenges. Northern England and Scotland face particularly acute shortages in specialist roles, limiting their ability to attract infrastructure investment.

The government’s infrastructure investment plans depend heavily on addressing these workforce gaps. Without decisive action, skills shortages could delay critical decarbonisation projects and undermine long-term economic competitiveness.

Private Sector Involvement and PPPs

Public-private partnerships (PPPs) remain essential for delivering the UK’s ambitious infrastructure goals. The current spending review allocates limited public funds, making private sector involvement crucial for bridging financing gaps.

New partnership models are emerging beyond traditional PPPs. Revenue-sharing arrangements and outcome-based contracts attract private investment whilst maintaining public oversight.

Successful partnership areas include:

- Renewable energy projects

- Digital connectivity initiatives

- Transport network upgrades

- Social housing developments

Risk allocation continues to challenge partnership negotiations. Private investors seek clarity on regulatory frameworks, particularly around decarbonisation requirements and planning permissions.

The National Wealth Fund represents a hybrid approach, combining public backing with private expertise. This model could unlock significant infrastructure investment across energy, transport, and digital sectors whilst ensuring strategic national priorities are met.

Environmental Sustainability and Policy Alignment

Decarbonisation requirements reshape every aspect of UK infrastructure planning and delivery. Net-zero targets by 2050 demand fundamental changes in how projects are designed, funded, and operated.

Green infrastructure investment has become a priority across government departments. The spending review increasingly favours projects that demonstrate clear environmental benefits and carbon reduction potential.

Policy alignment challenges include:

- Coordinating across multiple government agencies

- Balancing economic growth with environmental goals

- Ensuring consistent standards across regions

- Managing transition costs for legacy systems

Planning frameworks must adapt to support sustainable infrastructure development. Current processes often delay renewable energy projects and low-carbon transport initiatives, hindering progress towards decarbonisation targets.

Local authorities require additional resources and expertise to assess environmental impacts effectively. Without proper support, planning bottlenecks will continue to constrain sustainable infrastructure investment and delay critical climate objectives.

Hot Job Opportunities at Infraspec

Explore our latest roles in Infrastructure & Project Controls across the UK and Europe

- Associate Director – – London Industry: Infrastructure / Project Controls | Associate Director | Infraspec

- Senior Planning Engineer – London Industry: Transportation / Project Controls Planning Engineer | Senior Planning Engineer | Infraspec

- Risk Manager – London Industry: Infrastructure / Project Controls | Risk Manager | Infraspec

- Project Controls Specialist (PMO) – Peterborough Industry: Utilities | Project Controls Specialist (PMO) | Infraspec

- Commercial Manager – Essex Industry: Renewable energy / Project Controls | Commercial Manager | Infraspec

- Buyer/ Procurement – London Industry: Renewable energy / Project Controls | Buyer/ Procurement | Infraspec

If any of the job links are unavailable, feel free to send your CV directly to info@infraspec.co.uk.